EXCLUSIVE: 64% of immigrants not paying monthly bill on $150M government zero interest loans

Two-thirds of immigrants, including permanent residents, were not making minimum monthly payments on an outstanding $150 million in taxpayer-funded immigration loans. These loans carry zero interest.

Two-thirds of immigrants, including permanent residents, were not making minimum monthly payments on an outstanding $150 million in taxpayer-funded immigration loans. These loans carry zero interest and terms most Canadians could only dream of.

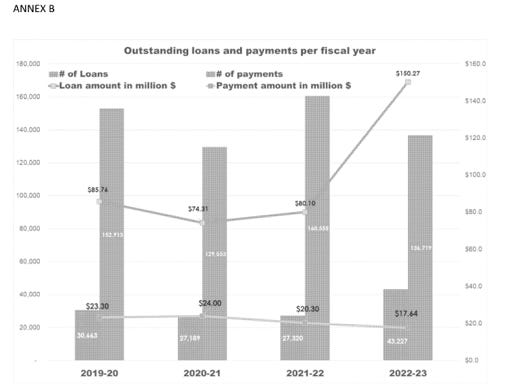

According to Access to Information records obtained by True North, federal officials reported that only 36 per cent of recipients of the Immigration Loans Program were making minimum monthly payments as of March 31, 2023 — down sharply from before the COVID pandemic.

“Before the pandemic, 59% of clients with outstanding loans were making required minimum monthly payments towards their loans compared to 36% at March 31, 2023. This translates to a total loan payment decrease from $20 million in 2021-2022 to $17 million in 2022-2023,” wrote immigration officials.

That means 64 per cent of immigration loan holders are possibly delinquent on their repayments. It is unclear how many of those failing to make minimum payments have entered deferred repayment or defaulted entirely on their loans.

Attempts by True North to receive further clarification from Immigration, Refugees and Citizenship Canada went unanswered.

By comparison, the average delinquency rate for Canadian consumers with non-mortgage debt sits at around 1.60%, according to Equifax data for Q1 2025. Even among young adults aged 26–35 — one of the riskiest borrowing groups — delinquency averages only 2.37%.

The documents also reveal that outstanding immigrant debt owed to Canadian taxpayers ballooned to over $150 million, nearly double the $80 million owed the year prior.

The Immigration Loans Program is a federal initiative run by federal immigration authorities that offers loans to foreign nationals applying for permanent residence under any category including refugee or asylum arrangement to cover the costs of immigrating to Canada.

“In addition, Canadian citizens and permanent residents may apply for a loan on behalf of a beneficiary,”explains the document.

Covered expenses include airfare, travel documents, and early resettlement costs. Repayment typically begins one year after arriving in the country on terms ranging from 36 months for $1,200 or less to eight years for loans over $4,800. For context, a $5,000 zero interest loan on the maximum term limit would constitute a payment of $52 a month.

Despite the fact the loans carry zero interest, the number of immigrant debtors not making minimum payments on their loans has skyrocketed.

Even student loan borrowers in Ontario have a higher repayment rate. The Ontario Student Assistance Program (OSAP) recorded a default rate of just 3.6% in 2022 across post-secondary institutions

A July 2023 memorandum to then-Immigration Minister Marc Miller noted that the debt spike on the immigration loan program was driven by a surge in new loans, after the Liberal government ramped up immigration levels to record highs. In the 2022–23 fiscal year, $87 million in new loans were issued, while just $17 million was paid back. That represents a net increase of $70 million in a single year.

The document also reveals IRCC temporarily suspended active collections in March 2020, halting statements and outbound calls to migrant borrowers.

According to the memo, the department was seeking approval to resume all collection activities under the program and that collection agents would begin making outbound calls and issuing monthly statements.

Despite bearing no interest, the immigration loans have seen declining repayments.

The department noted that clients continued to make payments voluntarily during the pandemic, but the drop-off in regular repayment presents sustainability risks for the program, which draws from the Consolidated Revenue Fund.

In July 2022, the IRCC doubled the funding available from $126 million to $250 million.

Collection agents were then instructed to resume "100% of their collection activities" while maintaining flexibility on deferrals or extended terms.

The department suggested in a section titled “communication implications”, that there could be possible public backlash over the optics of collecting taxpayer money from newcomers during a period of economic uncertainty.

In 2022-23 alone, over 33,000 immigration loans were issued, yet repayments fell below $18 million.

The number of payments dropped to its lowest level in four years.

The documents also show that IRCC handed out $819,000 in 2021–22 and $663,000 in 2022–23 to refugees deemed unable to repay, including the Safe Haven cohort, whose travel costs were fully subsidized through the Resettlement Assistance Program. Unlike Canada’s usual interest-free immigration loans, these contributions were unrecoverable taxpayer-funded subsidies provided to “exceptionally high needs” individuals.

These payments are just a fraction of the Trudeau government’s broader Afghan resettlement program, which brought over 55,000 migrants to Canada since 2021, often waiving standard travel and ID requirements.

The special measures — in place from 2021 until they quietly expired at the end of 2023 — applied to protected persons, family reunification cases, temporary residents, and Afghan nationals abroad linked to Canadian citizens or permanent residents.

The measures even covered dependents of resettled refugees.

Concerns have mounted over the past few years over the management of immigration assistance programs.

In 2024, a Statistics Canada study revealed troubling long-term outcomes for Syrian refugees resettled in Canada under Prime Minister Justin Trudeau’s program, showing persistently high rates of social assistance reliance.

The study found that 42.3 per cent of 2014 government-assisted refugees were still on welfare six years after arrival, rising to 50.4 per cent for the 2015 cohort. For 2016 arrivals, 69.5 per cent were receiving social assistance just four years after settling, making them among the worst-performing refugee groups in labour market integration.

Send them back home. This is not welfare state for your life.